Maybe you’ve stumbled across our Financial Independence Series or the FIRE Movement and you’ve decided you’re ready to take control of your future. You want to know how to become rich.

Fat bank accounts, big houses, and shiny fast cars right? Make it rain! $$$

But what those of us in the FIRE community really desire is not actually money – it’s FREEDOM. Having control over our time and the power to do what we want, when we want. That’s the goal. Money is just the tool to get us there. But freedom costs money, so here we are back to square one.

We need money to gain the richness of freedom.

There are many paths you can take to reach the summit of a mountain, but to reach your goal you need to know where you are and where you’re going right? It’s the same with becoming rich. You need to know where you are in your finances and where you’re planning to go.

Cutting to the chase, the first powerful life hack that will make you rich over time is TRACKING YOUR MONEY.

Check out the full video and subscribe to our YouTube channel. It helps us help you!

The First Step in Becoming Rich – TRACK YOUR MONEY

This by far is the first step on your journey to Financial Independence that will make a big impact. There’s an old saying in the investing world.

Figure out money and life is easy. Don’t figure out money and life is hard.

The first step in figuring out money is to have crystal-clear visibility into your finances and a simple, high-level view of the whole picture. You need to know where every dollar is coming in and going out of your life, because every dollar you earn and spend represents the life energy it took you to make that dollar.

Your life is well-worth the tiny ten minute effort it takes per month of hitting a few keystrokes because the insight you gain is priceless.

A big picture view helps you identify leaks in your financial plumbing like “Why am I paying for thousands of cable channels when what I actually like is watching Netflix and YouTube?” Tracking your finances helps shine light on the low-hanging, money-saving fruit that you can pick to give you a running start to the sweet land of Financial Independence.

No matter where you are with your finances, whether you’re in debt or have savings, one of the biggest life hacks you can make is to track your money. Why is that?

In the business world, it’s a well-known fact – things that get tracked get improved. Your money becomes top of mind. Just the simple act of tracking your money will start to make you richer because you’ll end up spending less.

It’s just human nature.

When you see dollars coming in and going out every month, you’re more likely to make better decisions on where you’re spending your precious life energy.

The Bottom Line – Your Net Worth

This brings us to the first item in tracking your money.

Your NET WORTH.

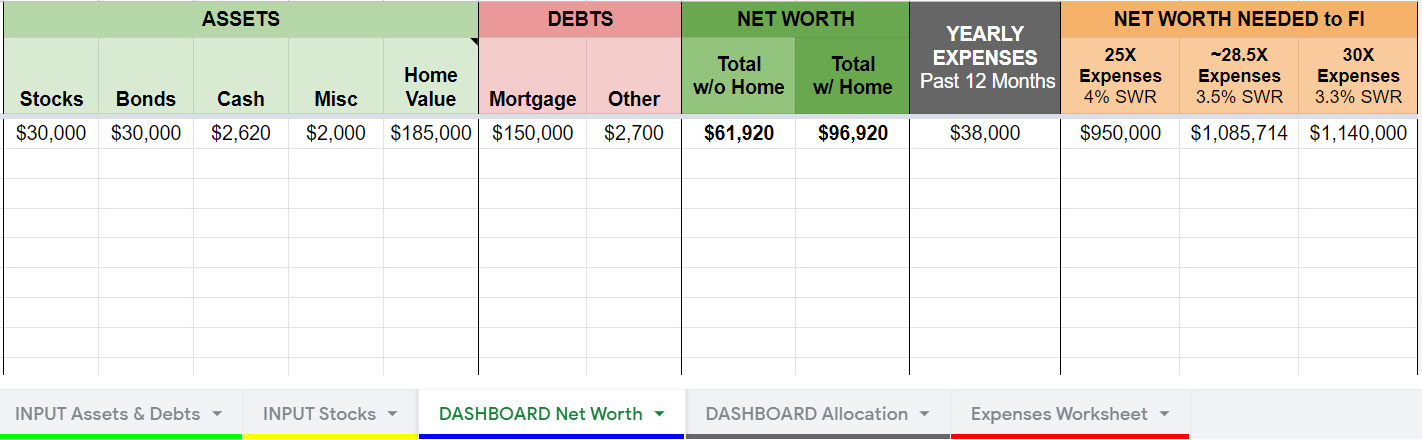

This is is the sum total of all of your assets minus your debts. It’s all of the money in your checking and savings account, the cash in your wallet, the value of your investments, what your house and car is worth, minus your debts like credit cards, mortgage, or any other loans you might have.

Don’t make the mistake of confusing your worth as a person with your financial Net Worth. It’s just a number in a spreadsheet. Your worth as a person is immeasurable and includes your values, talents, good deeds, and many other things.

Your Net Worth is the high-level number that represents the sum total of all of your life energy up until now. If you calculated how much money has come into and gone out of your life in your entire lifetime, it’s shocking. Try it.

Mo’ Money Less Problems

(Yeah I couldn’t help myself. ?)

If you’re starting off with a negative net worth, don’t worry. Since you’ve decided to take control of your finances and want to become rich, this number will start moving in the right direction. Over time the more you see your number increase, the more confidence you’ll have in every aspect of your life. Yes, money can’t solve all your problems, but it can give you a stable foundation to build happiness.

How about put another way?

“NO money MO’ problems.”

Now that’s actually starting to sound logical isn’t it? Money can’t solve all your problems, but at a baseline level, it can at least pay for your needs. Start tracking your money with the intention of growing your net worth and over time you’ll see your financial situation improve.

We can’t stress enough how powerful this life hack is. On top of that it’s totally FREE! It’s something you can start doing RIGHT NOW in the comfort of your home and we’re giving you a FREE Net Worth Tracking Tool at the bottom to help you get started.

It’s the first step on your journey to reaching your dreams.

How to Get Started Tracking Your Money

Okay let’s get into the nuts of bolts. You could literally use a pen and paper to track your finances every month, but that’s tedious and messy. An easier way is to create an Excel or Google spreadsheet and organize it with categories for expenses, income, or any way you like. Setup automatic functions to sum everything up and have your Net Worth number updated automatically.

An even easier way is to go one step further and use a financial aggregator like Personal Capital or Mint. These apps automatically log into all of your accounts and update your numbers for you. You get pretty pie charts showing all of your expenses and income and even a breakdown of your asset allocation. It’s all laid out in a simple dashboard where you have a view of your Net Worth in an instant.

Tracking your money can get messy very quickly, especially if you’re a couple. It’s not a big deal in the beginning when you just have a checking account and maybe one credit card, but the average Financial Independence enthusiast juggles a variety of accounts in several categories. To manually update a spreadsheet would mean logging in to numerous accounts like 401k, 403b, 457, IRA, HSA, checking, savings, brokerage, credit card, mortgage, car loan, student loan, and that’s only if you have one of each account!

Once a month we spend ten minutes manually updating our Net Worth tracking spreadsheet using the data that Personal Capital gathers for us. It’s automatic and gives us an impressive dashboard view of our finances. We’ve been using this powerful combination for years and it’s made our financial life a breeze. It helps us make better decisions so we can achieve our goals and get to our dreams faster.

Do yourself a favor and start tracking the numbers that are important to you. For us, we like tracking balances in the following six things:

- Stocks

- Bonds

- Cash

- House Value

- Mortgage Balance

- Total Expenses for the past 365 days

These six things tell us everything we need to know for our future goals. Your financial life will be different so decide what’s important to you and track it.

Use a simple spreadsheet with functions to total everything and use a financial aggregator like Personal Capital or Mint to automatically get the balance of each of your accounts. Once a month, pick a day to update your spreadsheet and spend a couple minutes plugging in the numbers. It’s so easy.

To simplify your life even further, take the time to combine and get rid of accounts you don’t need. If you have old 401ks, roll them into an IRA. Close old bank accounts and credit cards. It’s less to manage and helps you focus on what’s important.

A bonus hack we love is to funnel all of our expenses through a travel rewards credit card to pay for everything. Find a card with a nice sign up bonus and use it for all of your expenses. [We have a link below for the one we use] It’s called Travel Hacking. We both have a card on the same account to pay for everything so we can meet the sign up bonus. Use it for your actual expenses and MAKE SURE TO PAY IT OFF EVERY MONTH! Credit card interest can destroy life energy fast so if you can’t pay off your balance every month, don’t get a credit card.

Mission Control, We Have a Problem

Think of your tracking spreadsheet like mission control when the space shuttle launches. It’s there to monitor and identify any problems that might come up.

Tracking your money will help you easily spot a $20 fraud charge to your credit card or a $95 yearly subscription that you might have missed. Things like restaurants and coffee all add up and start to stick out in your expenses as places to improve on.

The nice thing about tracking your money is that there’s no judgement.

Your tracking spreadsheet doesn’t care if you buy a whipped caramel macchiato double shot coffee at Starbucks every morning. It just reports the facts. You have the power to decide what is and what’s not important to spend your life energy on.

I love strong coffee whipped up with a bit of sugar and coconut oil. It’s pure heaven for me. But I also consider future freedom pure heaven, which is why I don’t waste money buying expensive coffee. I make it myself at home with an AeroPress or AeroPress Go.

I think Vicki Robin would agree – your money is your life. When you’re working a job, you’re using your precious life-energy mining for dollars. Wouldn’t you consider monitoring the flow of your precious dollars in and out of your life, mission-critical to your future?

Start tracking your money. It’s the first step in becoming rich and will help you to get to the life of your dreams.

0 Comments