What if you had the freedom to do what you wanted every day for the rest of your life? To escape the rat race and design the life of your dreams. We’re going to show you the shockingly simple math that can take you from a net worth of zero to RETIRED in less than 10 years.

Yes, it’s totally possible and you’ll learn the strategy to make it happen. There are simple changes that you can make to cut years or decades off your working career and live a life of freedom.

It’s called FIRE, or Financial Independence Retire Early.

Check out the full video and be sure to subscribe to our YouTube channel. It helps us a ton!

Financial Independence is the point at which you have enough investments generating income to support your expenses for the rest of your life. You never need to work again. Did you know there are people that have hit Financial Independence and are retiring right now in their 30’s?

Interested? Check out one of the best books on retiring early.

The FIRE movement started out as a small community of financial bloggers composed mostly of engineers, architects and programmers, but has grown over the years to capture the attention of average people who simply want to live a more meaningful life on their own terms.

We’re sharing this with YOU, our friends, because we want you to be successful. We want you to have the best tools and information available to make your life better.

This isn’t a get rich quick scheme, but it WILL make you rich over time. It’s being intentional with your actions and designing your life in a way that leads you to Financial Independence. It doesn’t mean you NEED to retire early, but gives you the freedom to pursue your dreams and passions.

Maybe you’d like to travel more and learn about the world. Maybe you’d like to volunteer your time to make the world a better place? Or work on creative projects that don’t generate income but give you fulfillment. Wouldn’t it be a blessing to be “time rich” to be able to take care of a family member or friend if they needed you?

That’s the power of Financial Independence.

The road isn’t easy, but a lot of people have done it, many more are on the path right now, and you can do it too.

The Secret to Financial Independence and Early Retirement

Our journey started several years ago when some good friends forwarded us an article by a guy named Mr. Money Mustache called The Shockingly Simple Math Behind Early Retirement. He made a bold but simple observation that no matter how much or how little money you made, as it turns out, the amount of time it takes to get to Financial Independence depends only on one thing:

Your savings rate, as a percentage of your take-home pay

Let’s zoom in. Your savings rate is the gap between:

- How much you take home each year

- How much you can live on

No matter how complicated you think your finances are, it all boils down to your savings rate.

- If you’re spending 100% of your income, you will NEVER be able to retire.

- If you’re spending 0% of your income and can maintain this into retirement, you can retire RIGHT NOW.

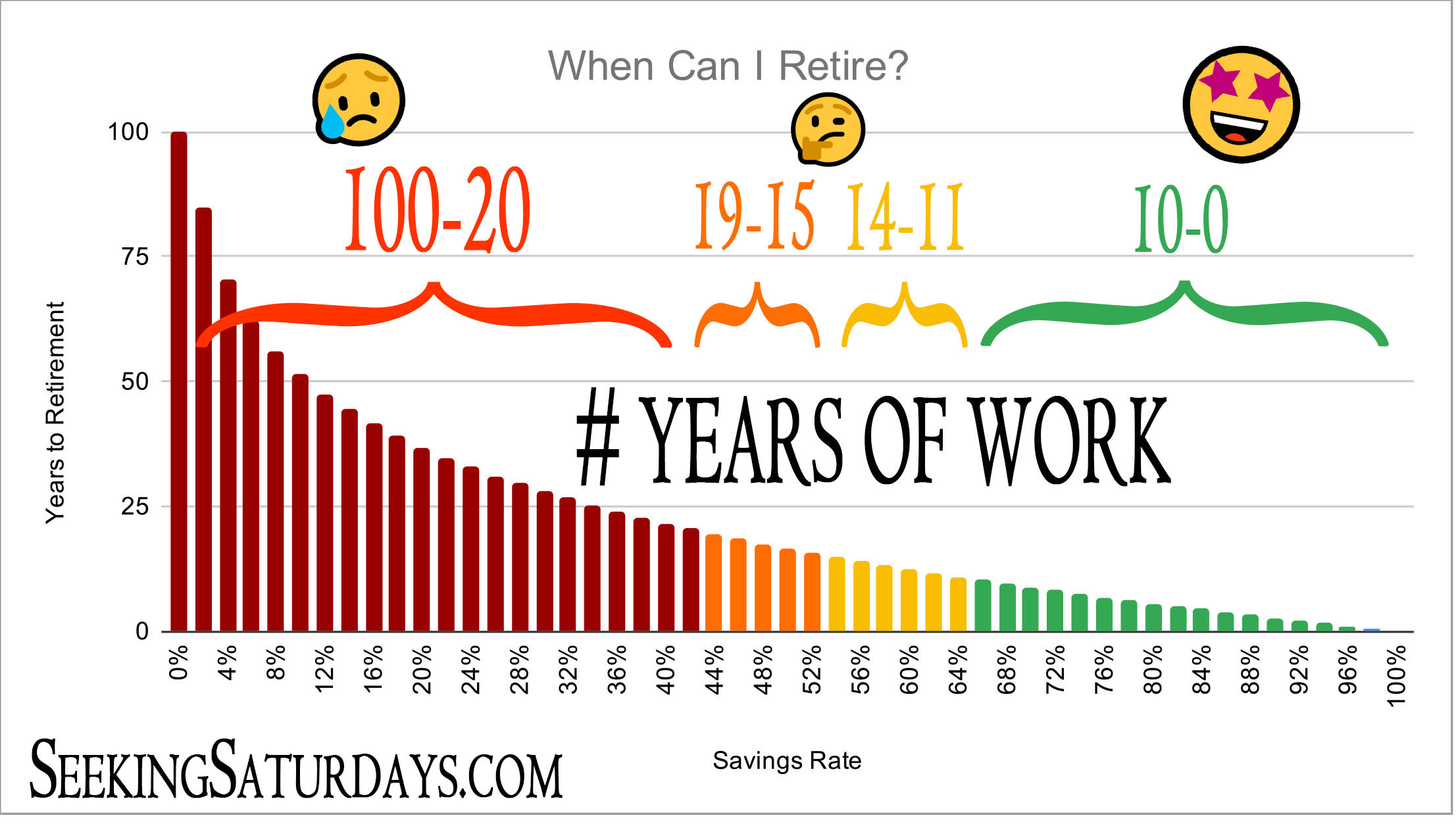

In between those two extremes are some interesting observations that you will want to pay close attention to, because increasing or decreasing your savings rate can give you a drastically different future. Seeing it in the form of a graph tells a powerful story.

This is the story of how increasing your savings rate can shave years or decades off of your working career.

Plug in your numbers at networthify.com

On the left is the number of years you need to work to get to retirement. On the bottom is your savings rate. It doesn’t matter how much you make or how much you spend each year, it’s your savings rate that matters.

Notice the exponential curve on the left? The more you save initially, the more of an impact you’re making on your future.

Most Americans are only saving a little over 5% of their paychecks. Plug a 5% savings rate into the calculator rate and you would need to work a whopping 65 YEARS to retirement!

Let’s say you’ve been given some good advice. You’re better than average and are saving double that at 10%. Plugging in the numbers brings your working career down to 51 years, or more than a decade sooner!

That’s a great start, but five decades is still a lot of your life spent at work. Let’s see if we can do better.

SAVE HALF (+)

If you want average results, do the average. But if you want real freedom, you need to think differently.

Plugging in a 50% savings rate into the calculator brings your entire working career down to just over 16 years! Now that sounds a little more doable right? Well I have a surprise for you. If you’re serious and can optimize your life further and achieve a savings rate of 67% or more, you can whittle your entire working career down to LESS THAN 10 YEARS.

What would you do with all that extra time?

Spend it with your family? Volunteer? Travel? Make the world a better place? How about lower your stress level, improve your health, and get the sleep you’ve needed so desperately? Financial Independence doesn’t mean not working. It means working on the things that are most important to you.

That’s the power of FIRE.

Assumptions

- You’re starting at Net Worth Zero. If you have savings already, you’re closer to your goal. But if you’re in debt, it will take you a little longer.

- You’ll earn 5% returns on your investments after taxes and inflation.

- You’ll live off the 4% Safe Withdrawal Rate, only touching the gains, and will keep expenses flexible in recessions.

- You won’t inflate you lifestyle and expenses after retirement.

- You plan on never earning another dollar in retirement. <– ?

Getting Started

Pick a goal. When would you like to become Financially Independent? Once you choose a goal, work towards it and make it happen. It’s incredible what a little bit of consistent effort over time can accomplish. This is truly powerful stuff. Especially with investing where your efforts compound on itself.

Every step is one step closer to the view at the mountain top. But it’s the decision to start that leads you to the mountain in the first place.

Choose what the goal is and take the first step.

How to Retire Early

Play with the numbers yourself and think about what extra expenses you could cut that are low hanging fruit. Think cable TV, cell phones, gym memberships, restaurants, magazine subscriptions. Anything you don’t necessarily care about. If making a few little changes and moving your savings rate from 10% to 15% would mean eight extra years you and your family’s life, wouldn’t that be worth it?

Even better, how about redesigning your life to tackle the BIG FOUR first?

- Housing

- Food

- Transportation

- Taxes

Want to get started? One of the best books on Financial Independence and Early Retirement is a book by a guy name J.L. Collins called The Simple Path to Wealth.

It’s truly incredible. You could start at zero and retire in 10 years or less. The math is simple and right in front of you. If you’re shaking your head in disbelief, instead of immediately dismissing this is not possible, ask yourself, how can I make it happen?

0 Comments